By merchantservicesindustry December 8, 2025

Credit cards feel simple to use—swipe, dip, or tap and you’re done. Behind that simple moment, though, is a complex credit card processing system moving data, verifying security, and transferring money in seconds.

This guide explains how credit card processing works, step by step, using plain language but staying detailed and accurate. It’s structured for both users and business owners, and optimized so search engines can understand exactly what this page is about.

What Is Credit Card Processing?

Credit card processing is the system that moves money from a cardholder’s bank to a business’s bank when someone pays with a credit card. It involves several players, specialized networks, strict security rules, and multiple types of fees.

When you pay with a card, you’re not just giving a business your money. You’re:

- Asking your card issuer (your bank or card provider) for a temporary loan

- Using a payment network like Visa, Mastercard, American Express, or Discover

- Relying on a payment processor and merchant account to route that payment

- Triggering a chain of approvals, messages, and settlements that completes in seconds

From a high level, how credit card processing works can be broken into three stages:

- Authorization – The card issuer checks if the transaction should be approved.

- Authentication & Clearing – Data is verified, and transaction details are prepared for settlement.

- Settlement & Funding – Funds move from the cardholder’s bank to the business’s bank.

Modern credit card processing also includes fraud tools, tokenization, encryption, and compliance frameworks like PCI DSS. As digital and contactless payments grow, processors are investing in AI fraud detection, real-time approvals, and tighter integration with online and mobile checkout experiences.

Understanding how credit card processing works is essential if you accept cards as a business, build payment software, or simply want to know what happens each time you tap your card.

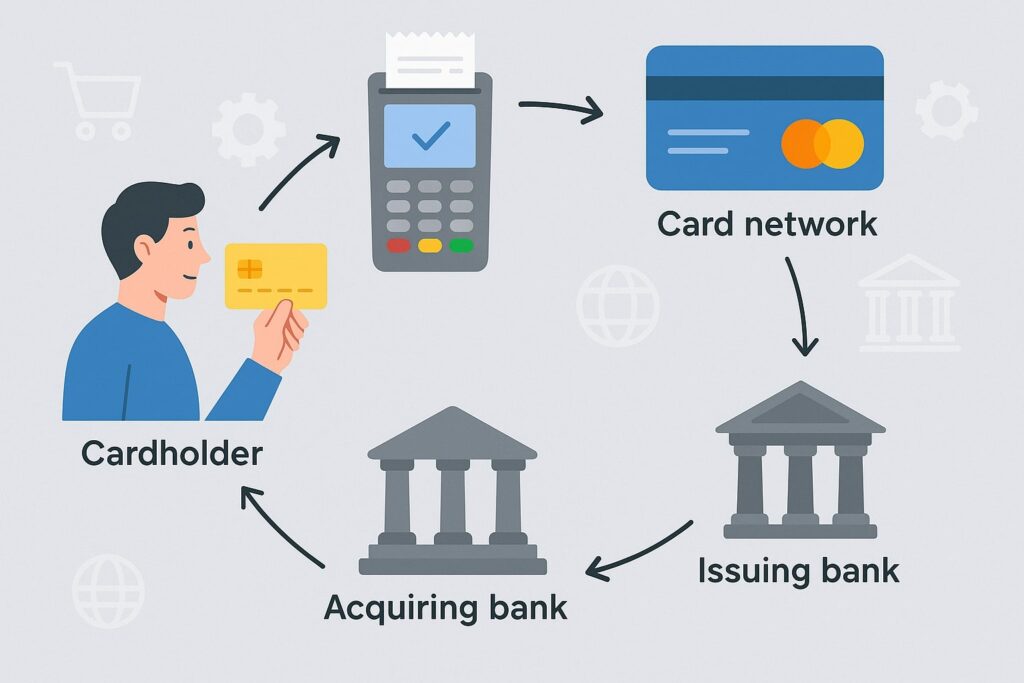

Key Players in the Credit Card Processing Ecosystem

To understand how credit card processing works, you first need to understand the roles of each party involved. Every card transaction passes through a network of participants, each with a specific job.

1. Cardholder

The cardholder is the person making a purchase with a credit card. They use a physical card, a digital wallet, or a stored card on file to pay.

Key points about the cardholder’s role:

- They initiate the transaction at a point-of-sale (POS), online checkout, or virtual terminal.

- They agree to the terms of their credit card, including interest rates and credit limits.

- Their available credit and account status determine whether a transaction is approved.

From a processing standpoint, the cardholder is the starting point of the credit card processing flow. Without a valid cardholder and account, the rest of the system can’t function.

2. Merchant (Business Accepting Cards)

The merchant is the business that accepts credit card payments in exchange for goods or services. This could be a retail store, restaurant, e-commerce site, professional service, or subscription business.

The merchant’s responsibilities in credit card processing include:

- Choosing a payment processor or merchant services provider

- Using compliant POS systems or payment gateways

- Following PCI DSS security requirements

- Paying processing fees, including interchange, assessments, and markups

Modern merchants also choose between traditional merchant accounts and payment aggregators (like PayPal, Square, Stripe, etc.) that bundle many merchants under one master account. This choice affects pricing, control, risk management, and how quickly they receive funds.

3. Acquiring Bank (Merchant’s Bank)

The acquiring bank (or acquirer) is the financial institution that provides the merchant with a merchant account. It:

- Accepts card transaction requests from the merchant

- Submits those transactions to the card networks

- Receives funds from issuers and deposits them into the merchant’s account

In some setups, the acquirer and payment processor are separate companies; in others, the same company acts as both. Either way, the acquirer assumes some risk, because it is technically responsible for chargebacks and compliance for merchants under its umbrella.

4. Payment Processor / Merchant Services Provider

The payment processor or merchant services provider is the technology and service company that:

- Connects the merchant to the acquiring bank and card networks

- Routes authorization requests and responses

- Provides POS software, payment gateways, terminals, and reporting tools

- Helps manage chargebacks, fraud tools, and PCI compliance

From a practical perspective, when people talk about “credit card processing,” they are often talking about this provider. The processor’s systems are what make authorization, settlement, and reporting usable and efficient for merchants.

5. Card Networks (Visa, Mastercard, etc.)

The major card networks—such as Visa, Mastercard, American Express, and Discover—provide the payment rails that carry transaction information between acquiring banks and issuing banks.

Their key roles in how credit card processing works:

- Set interchange rates paid to issuers

- Set network assessment fees paid by acquirers

- Define rules and standards for card acceptance and chargebacks

- Maintain secure, high-speed global transaction networks

These networks don’t usually issue cards themselves (except in some models like Amex) and they don’t extend credit directly (again, with some exceptions). Instead, they facilitate the ecosystem and establish the rules.

6. Issuing Bank (Cardholder’s Bank)

The issuing bank is the financial institution that issued the credit card to the cardholder. Examples include large consumer banks and co-branded card partners.

The issuer’s responsibilities:

- Approving or declining transactions

- Managing cardholder credit limits and account status

- Billing the cardholder and collecting payments

- Handling cardholder disputes and chargebacks

When a transaction runs, the issuer checks whether the cardholder has enough available credit and whether the transaction appears legitimate. If everything looks good, it sends an authorization approval through the network to the processor and merchant.

The Credit Card Transaction Flow: Step-by-Step

Now let’s walk through how credit card processing works in real time, from the moment a customer taps a card to when the business receives money. We’ll focus on in-person and online flows, since both are common.

1. Authorization: The Instant Approval (or Decline)

Authorization is the first and most visible step in credit card processing. It happens within a few seconds and determines whether a transaction can proceed.

In-Person Transaction Flow (Card Present)

- The cardholder inserts, taps, or swipes their card at a POS terminal or card reader.

- The terminal encrypts the payment data, including card number, expiration date, and transaction amount.

- The encrypted data is sent to the payment processor, then to the card network, and finally to the issuing bank.

- The issuer checks:

- Available credit

- Card status (active, blocked, expired)

- Fraud risks (location, amount, pattern)

- Available credit

- The issuer responds with an approval or decline code.

- The approval/decline flows back through the network to the terminal, which displays the result.

Online / E-Commerce Transaction Flow (Card Not Present)

- The customer enters card details at checkout (or uses a saved card or digital wallet).

- A payment gateway securely transmits the data to the processor.

- The processor sends an authorization request through the network to the issuer.

- The issuer responds with approval or decline.

At this stage, no money has actually moved to the merchant’s bank yet. Authorization simply reserves the funds or credit amount on the cardholder’s account and records the transaction details for later settlement.

Authorization is also where fraud detection and 3-D Secure (like Verified by Visa or Mastercard Identity Check) may trigger extra verification steps, especially for online purchases.

2. Authentication, Clearing, and Batching

Once a transaction is authorized, the merchant’s system:

- Stores the approved transaction temporarily in a batch

- Sends transaction data to the processor at the end of the day or at set intervals

- Allows the processor and card networks to perform clearing

Clearing is the process of exchanging detailed transaction information between the acquiring and issuing banks through the card networks. This includes:

- Transaction amount

- Merchant category code (MCC)

- Date and time of transaction

- Any additional data (tips, tax, etc.)

During clearing, networks help calculate the appropriate interchange fees and assessments. These fees are crucial to understanding how credit card processing works financially for businesses.

3. Settlement and Funding: Moving the Money

Settlement is where actual money movement happens.

- The acquiring bank sends the batch of cleared transactions to the card networks.

- The networks route settlement information to issuing banks.

- Issuers debit the cardholder’s accounts and pay the acquirers, minus interchange fees.

- The acquiring bank deposits funds into the merchant’s bank account, minus its own fees and markups.

Funding timing varies:

- Many processors fund merchants within 1–2 business days.

- Some offer same-day or next-day funding for an extra fee.

- High-risk or new merchants may experience longer funding delays.

From the merchant’s perspective, the key takeaway is that authorization, clearing, and settlement are separate steps in how credit card processing works—even though they are tightly integrated behind the scenes.

Types of Credit Card Transactions (Card-Present vs Card-Not-Present)

The way credit card processing works depends heavily on whether the card is physically present at the time of payment.

Card-Present Transactions

Card-present transactions occur when the cardholder physically presents a card or device:

- In-store at a checkout counter

- At a restaurant or service location

- Using a chip card (EMV), swipe (magstripe), or contactless (NFC)

Card-present transactions are generally considered lower risk because:

- The card is physically there

- The POS terminal can read chip data

- Additional verification like PIN or signature may be used

Because the risk is lower, interchange fees for card-present transactions are often lower than for card-not-present transactions.

Card-Not-Present (CNP) Transactions

Card-not-present transactions occur when the cardholder and card are not physically present:

- Online / e-commerce

- In-app transactions

- Mail-order / telephone-order (MOTO)

- Recurring or subscription billing with stored cards

These transactions are higher risk because:

- The merchant can’t physically inspect the card

- There’s greater exposure to stolen card numbers and fraud

- Disputes and chargebacks are more common

As a result, credit card processing for CNP transactions involves:

- Additional fraud tools (AVS, CVV checks, 3-D Secure, device fingerprinting)

- Higher interchange rates and processing fees

- Stricter scrutiny from processors for high-risk industries

Understanding the difference between card-present and card-not-present is vital for merchants trying to control costs and reduce fraud in their credit card processing strategy.

Payment Terminals, POS Systems, and Payment Gateways

Hardware and software are the “front door” into the credit card processing network. The tools merchants use directly affect the speed, security, and flexibility of processing.

EMV Terminals and Contactless Readers

Modern POS terminals support:

- EMV chip cards (insert)

- NFC contactless payments (tap)

- Traditional magstripe (swipe) as a fallback

EMV (Europay, Mastercard, Visa) technology makes card-present credit card processing more secure by generating a dynamic cryptographic code for each transaction, which is much harder to counterfeit than static magstripe data.

Contactless readers enable payments via:

- Contactless credit and debit cards

- Mobile wallets like Apple Pay, Google Pay, and Samsung Pay

- Wearables and other NFC-enabled devices

These technologies reduce friction for customers and support safer, faster transactions, especially in busy retail or quick-service environments.

POS Systems and Integrated Software

A POS system is more than just a card reader. It often combines:

- Inventory management

- Customer relationship tools

- Employee management and time tracking

- Sales analytics and reporting

- Integrated credit card processing

Many POS systems bundle payment processing through a specific provider. Others offer integrated payments where merchants can choose their processor but still enjoy deep software integration.

Payment Gateways for Online Transactions

For e-commerce and online businesses, a payment gateway is the software that securely:

- Captures card details on the website or app

- Encrypts and tokenizes sensitive data

- Sends transaction data to the processor for authorization

- Returns approved/declined responses to the website

Gateways are a critical part of how credit card processing works online. They must handle PCI DSS requirements, prevent card data from touching a merchant’s servers, and support modern features like:

- Hosted payment pages

- Saved payment methods

- Subscription billing

- One-click checkout

Gateways are often provided by the same companies that offer processing services, but merchants can sometimes mix and match based on business needs.

Fees and Pricing: What Credit Card Processing Really Costs

To fully understand how credit card processing works, you need to understand the fee structure. Card payments involve multiple fee types, and how they’re bundled or passed through depends on your pricing model.

1. Interchange Fees

Interchange fees are paid by the acquiring bank to the issuing bank on each transaction. They:

- Are set by the card networks (Visa, Mastercard, etc.)

- Vary by card type (rewards, corporate, debit vs credit), transaction method, and industry

- Typically represent the largest component of processing costs

Merchants effectively pay interchange because processors pass it through as part of the overall rate. Interchange compensates issuing banks for risks and costs, including fraud, customer rewards, and credit exposure.

2. Card Network Assessment Fees

Card networks also charge assessment fees to acquiring banks based on:

- Transaction volume on their networks

- Specific card types and international transactions

These assessments represent the “network fee” for using Visa, Mastercard, and others. As with interchange, they are ultimately passed on to merchants as part of the total cost of credit card processing.

3. Processor Markups and Additional Fees

The payment processor charges its own markup to cover:

- Technology and support

- Risk underwriting

- Customer service

- Value-added features (fraud tools, reporting, integrations)

Common billing models include:

- Interchange-plus – Interchange + network assessments + a transparent markup (e.g., 0.20% + $0.10 per transaction).

- Flat rate – Simple flat percentage (e.g., 2.9% + $0.30) regardless of card type, often used by aggregators.

- Tiered pricing – Grouping transactions into “qualified,” “mid-qualified,” and “non-qualified” tiers with different rates (often less transparent).

Other potential costs:

- Monthly account fees

- PCI compliance or non-compliance fees

- Chargeback fees

- Terminal or equipment rental

- Payment gateway fees

Understanding these costs is crucial for merchants evaluating how credit card processing works for their bottom line. Choosing the right pricing model and processor can significantly affect profitability.

Security, Compliance, and Fraud Prevention in Credit Card Processing

Security is at the heart of how credit card processing works today. With rising data breaches and card fraud, processors, networks, and merchants must follow strict rules and deploy advanced tools.

PCI DSS Compliance

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to protect cardholder data.

Merchants and service providers that handle card data must:

- Maintain secure networks and systems

- Protect stored cardholder data

- Encrypt transmission of card data over public networks

- Implement strong access controls and authentication

- Regularly monitor and test security systems

Depending on transaction volume and setup, merchants may need:

- Annual self-assessment questionnaires (SAQs)

- Quarterly network vulnerability scans

- Onsite audits for large enterprises

Modern processors often help merchants reduce their PCI scope by using tokenization and hosted payment pages, so raw card data never touches the merchant’s own servers.

Tokenization and Encryption

To secure credit card processing:

- Encryption scrambles card data at the point of entry (e.g., POS or checkout form) so it can’t be read if intercepted.

- Tokenization replaces card numbers with random tokens. The token can be used for future charges, but only the processor can map it back to the actual card.

These methods:

- Reduce exposure to card theft

- Limit the impact of data breaches

- Make recurring billing and saved cards safer

Tokenization is especially important for subscriptions, card-on-file billing, and mobile wallets.

Fraud Detection and Machine Learning

Fraud prevention tools in modern credit card processing include:

- Address Verification Service (AVS)

- CVV/CVC code verification

- Velocity checks (limit number of attempts or rapid transactions)

- Device fingerprinting and geolocation checks

- 3-D Secure and step-up authentication

More recently, processors and issuers are using AI and machine learning models trained on massive transaction datasets to:

- Detect suspicious patterns in real time

- Score transactions based on risk

- Adapt to new fraud tactics quickly

As e-commerce and card-not-present transactions grow, these tools are becoming one of the most important parts of how credit card processing works behind the scenes.

Chargebacks, Disputes, and Risk Management

No explanation of how credit card processing works is complete without covering chargebacks and risk.

What Is a Chargeback?

A chargeback occurs when:

- A cardholder disputes a transaction with their issuing bank.

- The issuer temporarily reverses the payment and debits the acquiring bank.

- The acquirer and merchant must respond with evidence to prove the transaction was valid.

Reasons for chargebacks include:

- Fraud (cardholder claims the transaction wasn’t authorized)

- Goods not received or services not provided

- Product not as described

- Duplicate charges or processing errors

Chargebacks are costly because merchants may lose:

- The sale amount

- The product or service delivered

- Chargeback fees

- Potentially their merchant account if disputes are excessive

How Processors Help Manage Risk

Payment processors and merchant services providers help with:

- Chargeback alerts and management tools

- Recommended documentation practices

- Fraud filters and blocking rules

- Monitoring chargeback ratios and advising on mitigation

High chargeback ratios can lead to higher processing fees, rolling reserves, or even account termination. That’s why risk management is a key part of how credit card processing works for merchants in the real world.

Future of Credit Card Processing: Trends and Predictions

Credit card processing is rapidly evolving. Understanding where it’s heading helps businesses choose the right technology and strategy.

1. More Contactless and Mobile Wallet Payments

Contactless adoption continues to grow due to convenience and hygiene preferences. Expect:

- Higher share of tap-to-pay cards at POS

- More customers using mobile wallets and wearables

- Faster average transaction times

For merchants, supporting contactless is no longer optional—it’s a core part of how modern credit card processing works.

2. Deeper Integration with Real-Time Payments and Open Banking

While traditional card processing still relies on batch settlement, the industry is slowly converging with real-time payment rails and open banking initiatives. Over time, we’re likely to see:

- Hybrid solutions combining card rails with instant bank-to-bank transfers

- More transparent fees and faster settlement options

- New business models that blend card processing with account-to-account payments

Processors that adapt to these changes will become more like omnichannel payment orchestration platforms than simple card-only providers.

3. Smarter Fraud Prevention and Identity Verification

Fraudsters are increasingly sophisticated. In response, future credit card processing will lean heavily on:

- Behavioral biometrics

- Continuous authentication

- Stronger customer identity verification

- Real-time risk scoring at both issuer and processor levels

Expect smoother, passwordless experiences for legitimate customers and more targeted friction when risk is high.

4. Simpler Pricing and Greater Transparency

Merchants are demanding clearer insight into how credit card processing works financially. This is driving:

- Wider adoption of interchange-plus pricing

- Detailed analytics on effective rates by card type, channel, and location

- Competitive pressure on hidden fees and long-term contracts

Over time, transparency will likely become a standard expectation rather than a differentiator.

FAQs

Q1. What are the main steps in credit card processing?

Answer: The main steps in credit card processing are:

- Authorization – Card data is sent to the issuer through the processor and network; the issuer approves or declines.

- Clearing – Transaction details are exchanged between acquirer and issuer through the card network.

- Settlement – Funds move from the issuing bank to the acquiring bank, and then to the merchant’s account.

All of this usually happens within 1–2 business days for funding, even though authorization takes only a few seconds.

Q2. Who pays the fees in credit card processing?

Answer: The merchant ultimately pays the fees in credit card processing. While interchange is technically paid by the acquiring bank to the issuing bank, processors pass all costs on to merchants as:

- Interchange fees

- Network assessments

- Processor markups and service fees

Some businesses choose to surcharge or add convenience fees where allowed by law, but the standard model assumes the merchant absorbs processing costs.

Q3. Is credit card processing different for online and in-person payments?

Answer: Yes. Card-present (in-person) and card-not-present (online) credit card processing differ in risk and cost:

- Card-present is generally lower risk and has lower interchange fees.

- Card-not-present is higher risk, more prone to fraud, and has higher fees.

- Online processing requires gateways, additional security checks, and robust fraud tools.

But at a high level, the same basic flow—authorization, clearing, and settlement—still applies.

Q4. How long does it take to receive funds from credit card processing?

Answer: Funding timelines vary by processor, merchant type, and risk profile. Common options include:

- Standard funding – 1–2 business days after batch submission

- Next-day funding – Available with many processors for an additional cost

- Same-day funding – Offered in certain setups or for specific industries

New or high-risk merchants may see longer delays or rolling reserves as part of their credit card processing agreement.

Q5. How can a business lower its credit card processing fees?

Answer: To reduce the cost of credit card processing, businesses can:

- Negotiate interchange-plus pricing with transparent markups

- Reduce card-not-present risk by using AVS, CVV, and fraud tools

- Optimize how transactions are entered (avoiding key-in when swiping or dipping is possible)

- Ensure correct merchant category codes (MCC) and transaction data

- Avoid unnecessary gateway and add-on fees

Regular statement reviews can reveal hidden costs or misclassified transactions.

Conclusion

Every time a customer taps, swipes, or types in a card number, a sophisticated credit card processing system springs into action. It involves cardholders, merchants, acquirers, issuers, card networks, processors, and security tools all working together within seconds.

By understanding how credit card processing works, you can:

- Make informed decisions when choosing a payment processor or merchant services provider

- Better control your fees, chargebacks, and risk

- Offer smoother, safer payment experiences to your customers

- Prepare for future shifts toward contactless, mobile, and real-time payments

Whether you’re launching a new business, upgrading an existing payment system, or just curious about what happens behind that “Approved” message, this knowledge gives you a clear advantage.

The more you understand about credit card processing now, the better positioned you’ll be as payment technology continues to evolve.

Leave a Reply